Table of Content

Barry Eitel is a content writer and journalist focused on insurance, small business and finance. He has researched and written about personal finance since 2012, with a special focus on entrepreneurship, freelancing and other small business operations. His writing on insurance and small business has been featured in 7x7, Brit + Co, Intuit Quickbooks, Bankrate, Policygenius and Lendio.

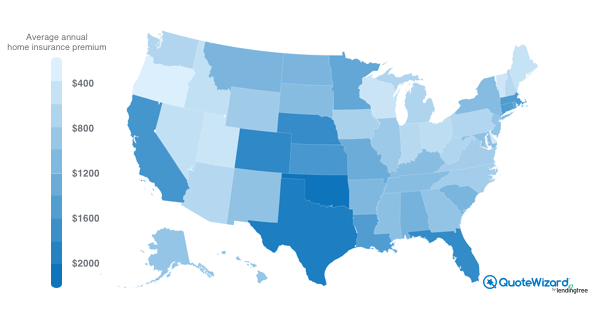

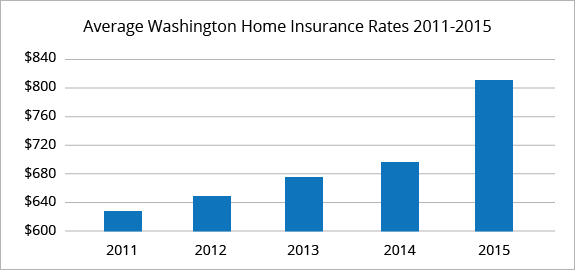

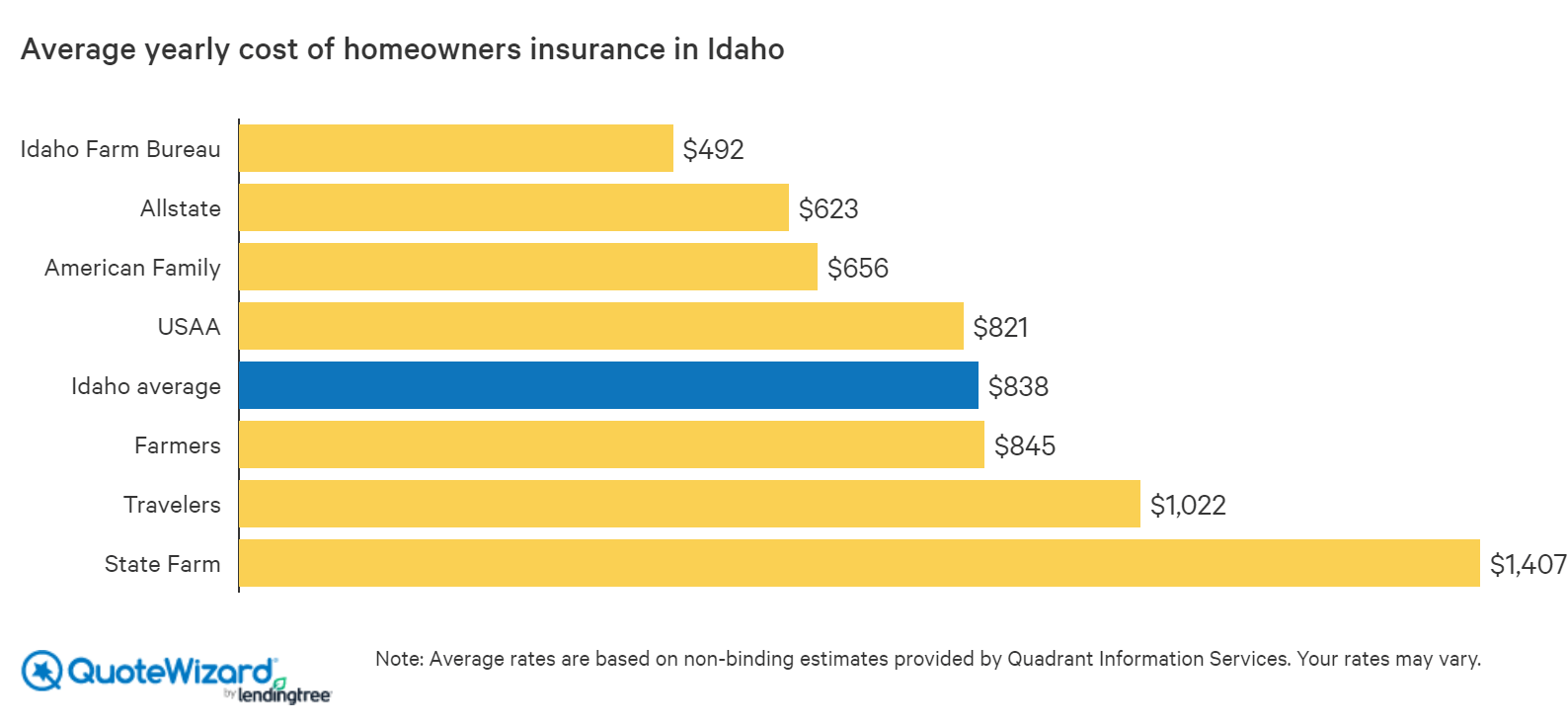

What you pay for coverage depends on many factors, but one of the major variables is where you live. Our home insurance calculator lets you get a home insurance estimate for your ZIP code at various coverage levels. You'll see the average rate, as well as the highest and lowest fielded from major carriers. While many factors go into calculating your homeowners insurance rate, where you live is one of the most important.

What is a 12-month premium?

You can bundle pretty much any State Farm insurance product and save , but the big fish on State Farm’s multiple line discount menu is its auto and home insurance bundle. But, you still may be able to purchase flood insurance if your community participates in the National Flood Insurance Program . In fact, most flood insurance is written through the NFIP, administered by the Federal Emergency Management Agency . It normally takes 30 days from the date of purchase to go into effect.

Our guide tells you how much home insurance costs on average in every state. The nationwide average annual cost for home insurance for common coverage levels, based on a rate analysis by Insurance.com are as follows. To obtain coverage, you must submit an application to State Farm®. All applications for coverage are subject to underwriting approval and subject to applicable state, provincial, and federal law.

Home and property insurance

Ting makes smart sensors that detect bad wiring before it turns into a disaster. With a State Farm home insurance plan, you get three years of Ting on the house. So, in case there was any doubt, yes, you can save big by bundling with State Farm. For the rest of the family, State Farm’s Drive Safe & Save app tracks everything from cornering and braking to “distracted driving” moments.

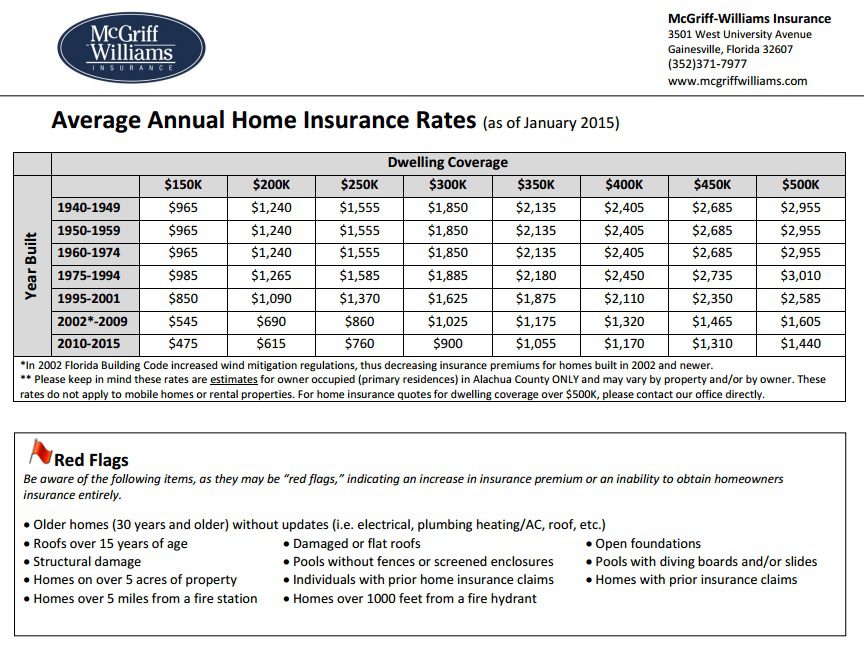

Typically, rural areas and cities with low population density have lower home insurance rates because rebuilding costs tend to be more affordable. Your child likely won't be able to be on your auto policy any longer because he or she doesn't live in your household. If you're the parent who isn't listing the child on your car insurance, your child can still drive your car and be covered by your insurance. Living near a full-time fire station with a nearby hydrant plays a role in your home insurance rates.

Average homeowners insurance rates by state by coverage level

You can also use the home insurance calculator below to see what average rates are in your neighborhood. Remember you can lower your rate by making sure you receive all the home insurance discounts for which you qualify. For example, buying your home insurance from the same company that covers your cars, called bundling, can save you an average of 19%.

To put that number into perspective, that’s over $30 cheaper than the average homeowners rate in the U.S., and about $20 less than North Carolina’s lower-than-average home insurance rates. When I added the works to my State Farm test policy, my monthly premium was still only $138. The works, in this case, were $65,000 in additional replacement cost property coverage , water backup insurance, special computer coverage, and earthquake coverage. “One major factor in Hawaii is the fact that most standard homeowner insurance policies do not cover hurricane damage. Hurricane Iniki, which hit in 1992 did so much damage that the majority of insurers excluded hurricane damage from their coverage. Homeowners in Hawaii now have to purchase a separate hurricane damage policy,” says Michael Barry, spokesman for the Insurance Information Institute.

Within each of these coverage options, you'll be able to select exactly how much damage you want to be covered for. For example, suppose you have a $30,000 bodily injury liability coverage policy. In that case, your insurer will cover up to $30,000 worth of the medical bills for the other driver who was injured in the accident. ZIP codes in Weatherford, Oklahoma and Hubert, North Carolina rank second and third, respectively. Real estate, famously, is all about location, location, location.

Besides tornados, hail damage is another reason home insurance rates are much more expensive in Kansas than in most other states. It’s no surprise that many of the most expensive ZIP codes for homeowners insurance are in states that experience lots of severe weather. Texas, Kansas, Oklahoma, Florida, Alabama and Mississippi have a lot of tornadoes as well. A higher deductible can reduce your insurance premium by 20% – 40% on average, depending on your insurer and coverage level. Oklahoma has the highest average cost of homeowners insurance at $5,317, based on an Insurance.com rate analysis. Below you'll see the top five most expensive states for homeowners insurance.

The rates we discovered are best used for comparative purposes — your own quotes from these insurers may be different. Where Erie insurance is available, you may be able to take advantage of even better rates. A policy with Erie costs $883 per year or $74 per month, which is 47% cheaper than the national average.

Allstate also splits up its deductibles by peril, meaning you only pay the deductible for the peril that impacts your home and property. The convenient home inventory app also makes keeping up with your property easy. After considering all of these factors , State Farm will provide a custom rate for your auto insurance policy. According to our research, State Farm policies vary widely in cost based on hundreds of factors. You could spend anywhere from $736 to $3,022 per year for State Farm car insurance.

Today, State Farm remains the top auto, property, and casualty insurance company in the US. The company owes much success to its iconic red tri-oval logo, which was updated in 2012. Interestingly, State Farm relies on “captive agents” to sell insurance, who are contractors that are only allowed to sell State Farm insurance. Like most major insurance providers, State Farm is actually pretty fair when it comes to cancelling your coverage. You can either cancel in person, by mail or by phone - and tell them that you wish to cancel your policy.

Just make sure that you choose an amount you could reasonably afford to pay should an unexpected event damage your home. State Farm offers the cheapest insurance in the state for $2,362 per year. State Farm is undoubtedly the best insurance provider for new homeowners, especially if you’re having your home built. By upgrading home alarms, fire sprinklers, and roofs, you can instantly save a ton on a State Farm policy. Combined with their easy-to-understand approach, they’re a great first-time pick for new homeowners.

Be sure to get the right condo unit insurance coverage that protects what you own. Claims-free discount, with 10% savings for customers who make no claims for five or more years. For a married person (if he/she is the single earner) there will be a deduction for income tax of 1,038 Euro and for social insurance of 1,166 Euro. While every state has areas where rates are cheaper, there are also reasons why a state like Hawaii has such low rates overall. WalletHub Answers is a free service that helps consumers access financial information. Information on WalletHub Answers is provided “as is” and should not be considered financial, legal or investment advice.

No comments:

Post a Comment